Why Raising a Growth Round Is Getting Much Harder

Most

companies that raise their seed and Series A rounds fail, primarily

due to a few reasons:

Most

companies that raise their seed and Series A rounds fail, primarily

due to a few reasons:

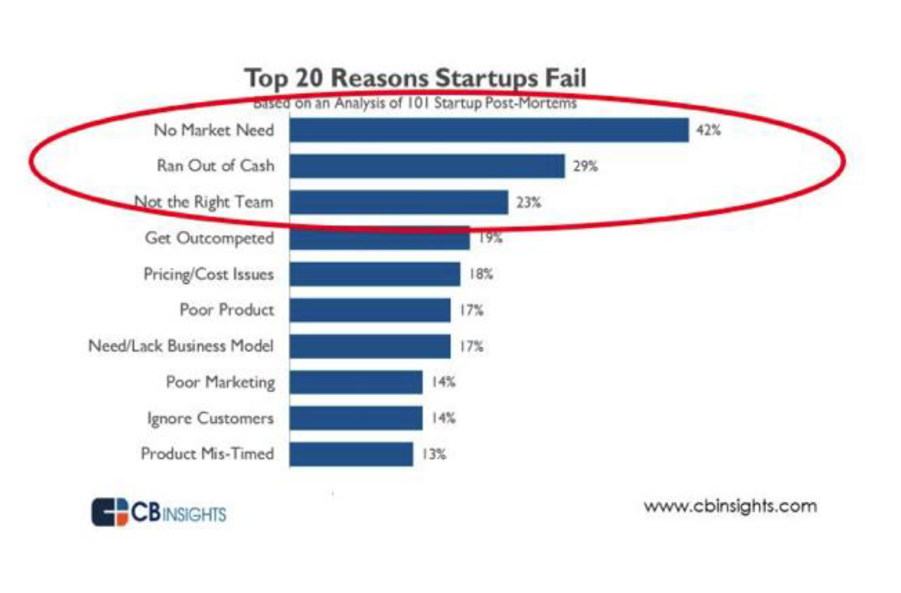

Lack of product-market fit and team issues are common. The most common

reason, however, is the lack of access to capital, especially growth

capital. The result is that less than 25% of funded startups go on to

raise a Growth round, according

to Crunchbase News. Given the

increase

in

seed-stage

deal

sizes,

companies are

more

developed

and

demonstrate

more

traction

when

they

raise

their

Series

A.

Given this

environment,

two converging trends are

making

it

more

difficult

to

raise growth (B)

round. This leaves many startups

in a difficult position, as they will need additional time and

funding

to

bridge

the

gap

needed

to

scale

to

the

higher

levels

now

required

for

a

growth round resulting in higher

pre-money valuations. This is due to many reasons:

Lack of product-market fit and team issues are common. The most common

reason, however, is the lack of access to capital, especially growth

capital. The result is that less than 25% of funded startups go on to

raise a Growth round, according

to Crunchbase News. Given the

increase

in

seed-stage

deal

sizes,

companies are

more

developed

and

demonstrate

more

traction

when

they

raise

their

Series

A.

Given this

environment,

two converging trends are

making

it

more

difficult

to

raise growth (B)

round. This leaves many startups

in a difficult position, as they will need additional time and

funding

to

bridge

the

gap

needed

to

scale

to

the

higher

levels

now

required

for

a

growth round resulting in higher

pre-money valuations. This is due to many reasons:

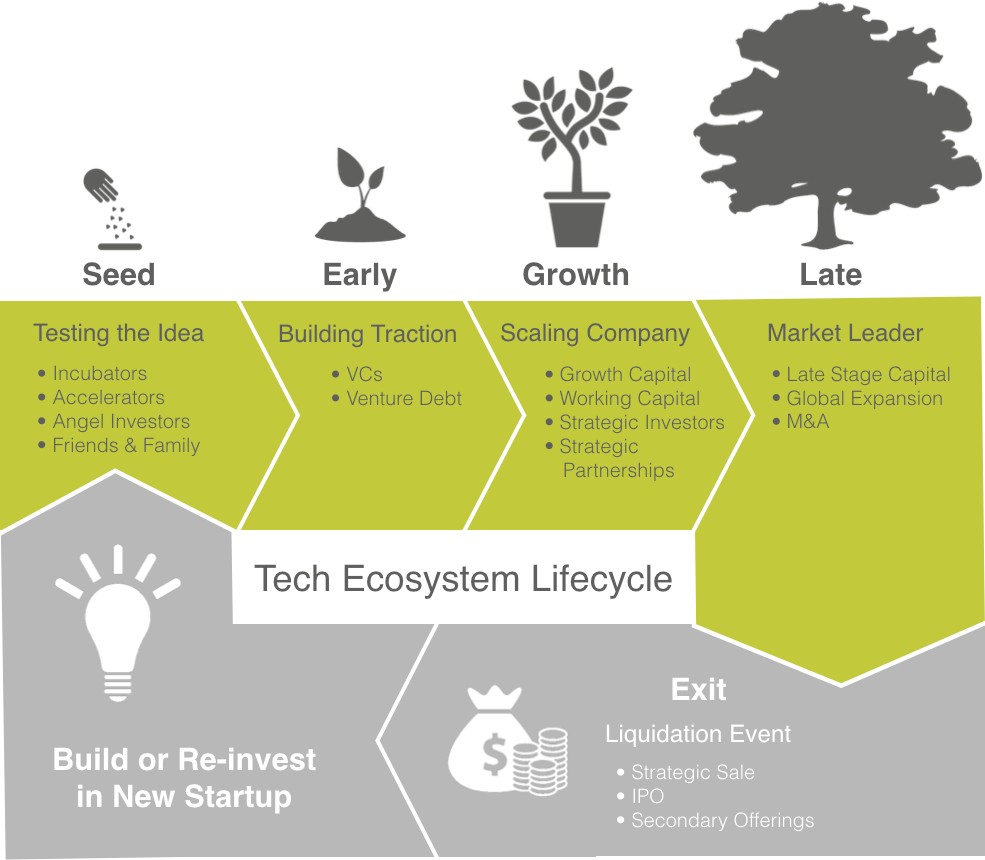

- Allocation

of Capital: Over the past several

years, the vast majority of the capital has gone to the two ends of

the spectrum; seed & early stage and late stage.

-

Growing

Number of Seed & Early Stage Funds:

the significant increase in the number of accelerators, incubators,

as well as pre-seed, seed, and early-stage funds in most geographies

in the past few years has resulted in a growing number of startups

being funded every year that will need growth capital beyond Series

A to continue scaling toward an eventual successful liquidation

event. That has increased the competition for growth rounds.

-

Small

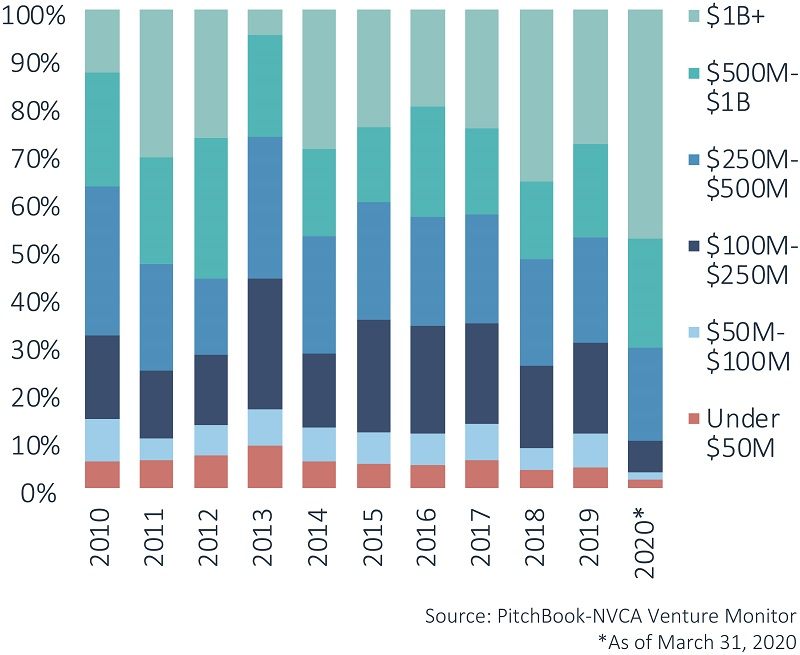

Allocation of Capital to Technology Growth:

The amount of capital allocated to technology growth is a very small

portion of the total capital.

-

The Desire by Growth Funds to Write Bigger Checks:

The size of growth rounds has grown significantly over the years and

with it the growth round valuations and expectations. They

expect

companies

to

be

in

the

expansion

stage

at

this

point with,

demonstrated

product-market

fit,

repeatability,

and

an

efficient

go-to-market

engine. They look for great

teams, significant traction, strong metrics and unit economics,

recurring revenue, and highly defensible models, resulting in a

considerably higher bar that start-ups need to

meet to qualify for growth

funding, resulting in higher

pre-money valuations.

-

The

emergence of the Mega Funds: There

are now numerous funds over $10bb each totaling over a trillion

dollars in dry powder. The desire to deploy this capital is

resulting in bigger checks and higher valuations.

The Result: Startups looking to raise a successful growth round need to understand that it may take longer and require more capital to be ready for a growth round. They need to proactively look at the necessary metrics, unit economics, and required runway, and ensure they have enough capital to get there.

Ivan Nikkhoo an experienced entrepreneur, investment banker, and venture capitalist at Navigate Ventures.

Tony Greenberg

Tony Greenberg

Michael Sherman, Neil Elan and Karine Akopchikyan

Michael Sherman, Neil Elan and Karine Akopchikyan Alejandro Guerrero

Alejandro Guerrero Eric Eide, Alliance for SoCal Innovation

Eric Eide, Alliance for SoCal Innovation Kevin DeBre

Kevin DeBre Braven Greenelsh

Braven Greenelsh Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank

Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank Braven Greenelsh

Braven Greenelsh Kaäre Wagner, Silicon Valley Bank

Kaäre Wagner, Silicon Valley Bank Al Guerrero, Silicon Valley Bank

Al Guerrero, Silicon Valley Bank Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank

Rob Freelen, Los Angeles Market Manager, Silicon Valley Bank Sid Mohasseb

Sid Mohasseb William Hsu

William Hsu Dinesh Ravishanker

Dinesh Ravishanker Dina Lozosfky

Dina Lozosfky Melinda Moore

Melinda Moore Jaspar Weir

Jaspar Weir Erik Caso

Erik Caso Tracy Olmstead Williams

Tracy Olmstead Williams Dave Berkus

Dave Berkus Bernard Luthi

Bernard Luthi Peter Cowen

Peter Cowen Nick Hedges

Nick Hedges Eric Larsen

Eric Larsen Michael Terpin

Michael Terpin Steve Reich

Steve Reich